Dealer Challenges and Priorities

In 2023, dealers faced numerous challenges due to a difficult geopolitical context, rapidly increasing costs, and other economic pressures. When asked to identify their top three challenges, most dealers pointed to the political and economic volatility affecting demand. This concern, consistent with previous years, was exacerbated by the negative effects of wars and political instability, leading to poorer sales. Economic issues such as inflation and interest rates were also significant concerns. Additionally, some dealers worried about the impact of politics on artistic freedom and expression, affecting what collectors were interested in purchasing.

One dealer noted, "The external environment is becoming increasingly difficult”. Even the most determined collectors seem tired. Faced with significant global changes and emergencies, many people question the purpose of continuing to collect. Instead, there is a trend towards purchasing more aesthetic and consoling works rather than those with social and political value. This is challenging for those in the primary market."

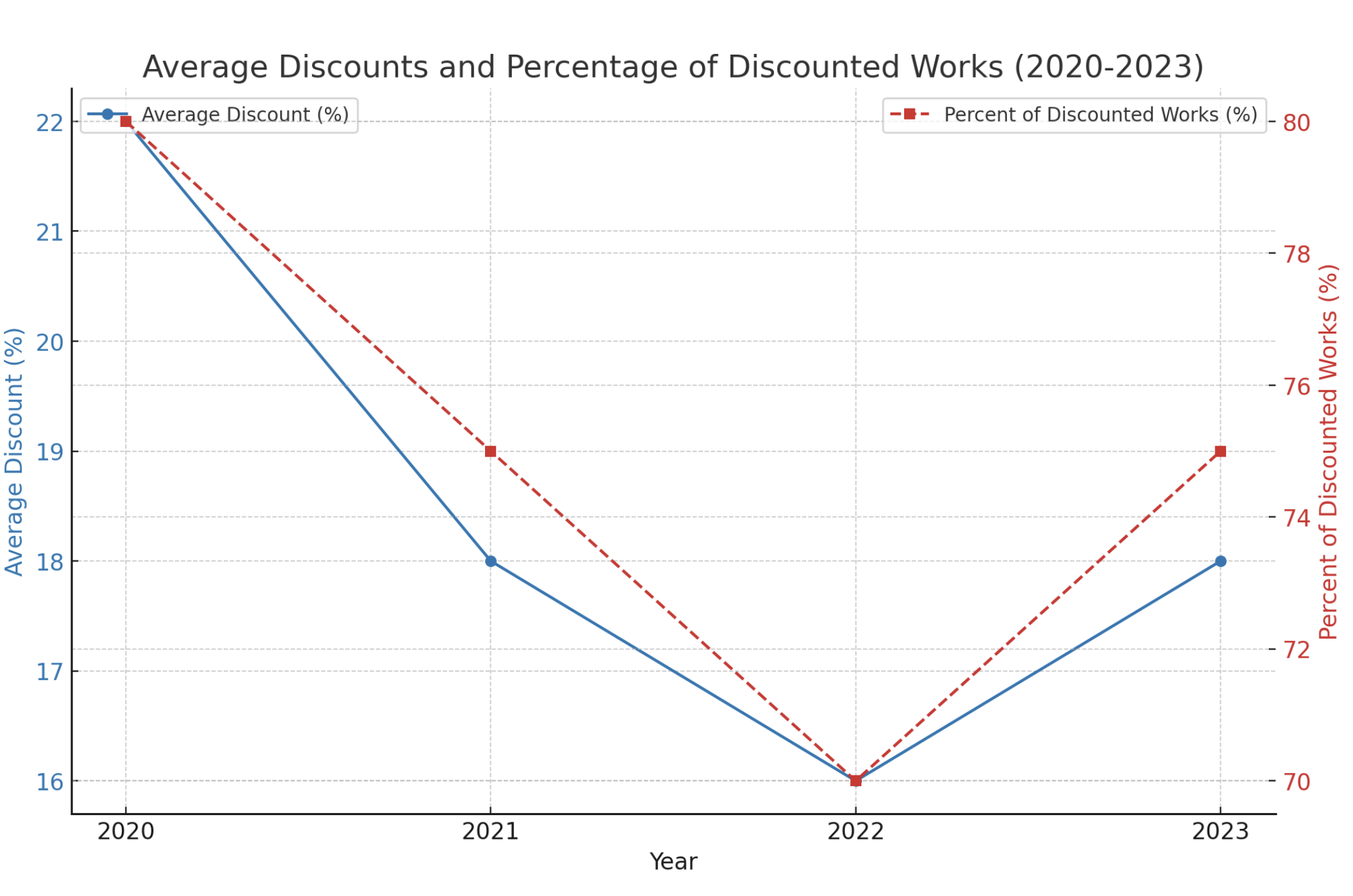

Dealers also observed a reluctance among some collectors to buy high-priced or major works due to the political and economic context. While lower-priced works saw better sales, many dealers had to offer greater discounts to close sales. Although specific discount levels were not surveyed, data from Artsy indicated that average discounts increased to 18% in 2023, especially for more expensive works.

There was also an increase in prepurchase conversations between dealers and buyers, suggesting more negotiation or effort to maintain connections. These trends were noted in both online and offline transactions, with some dealers describing the sales process as slower and requiring more effort in 2023.

Maintaining relationships with existing collectors was the second-highest-ranked challenge, reflecting its importance from 2020 to 2022. Finding new buyers and expanding geographically remained top priorities, with dealers facing challenges in using social media and other tools to attract younger buyers. Despite this, establishing long-term relationships with collectors was preferred for its positive financial and artistic outcomes.

The second half of 2023 has been incredibly tough with the effects of war and mortgage increases. With so many art advisors, galleries, websites, artists selling directly to collectors, and fairs, it is easy to get lost. This makes it harder to reach and find new clients and establish trust," one dealer commented.

Looking ahead, while maintaining current relationships remains crucial, expanding geographical reach is becoming more important. Economic challenges may decline in impact, with issues like expanding premises and sustainability gaining attention.

Dealers also faced challenges with different sales channels. Expanding online sales and exhibitions was a top concern, and the costs of participating in art fairs were significant. Although art fairs were a high priority in previous years, the costs of exhibiting, travel, accommodation, and other logistics were burdensome, with some dealers finding that expenses outweighed sales in 2023.

Overheads like payroll and rent were significant priorities, with escalating rents in certain cities pushing dealers towards consulting models instead of curatorial work. Inflation in supply and distribution chains, including shipping, insurance, and storage, added to these pressures.

Increasing regulations and barriers to cross-border trade in art and antiques, while lower in priority, presented specific regional challenges, such as high VAT rates in parts of the EU and complex cultural property regulations in the US and other major markets.

Despite these challenges, the sector remained optimistic about 2024. Most dealers expected stable or improving sales, with fewer predicting lower sales for their businesses.

Average Discounts And Percentage Of Discounted Works (2020-2023)

Chart illustrating the average discounts and the percentage of discounted works from 2020 to 2023. The blue line represents the average discount percentage, and the red dashed line represents the percentage of works that were discounted.