Why Buy Art? Why Invest in Art?

Art has been a cornerstone of culture and human expression for centuries. Beyond its aesthetic appeal, art offers a unique combination of emotional, intellectual, and financial rewards. Whether you are an avid collector, an investor, or a first-time buyer, the benefits of buying and investing in art extend far beyond the surface.

The Case for Buying Art

Cultural and Emotional Value

Art serves as a gateway to understanding history, society, and culture. By purchasing art, you preserve and celebrate cultural heritage, supporting narratives that resonate with your values. Art has the unique ability to evoke emotions and inspire introspection. Owning a piece that resonates with you can bring joy, solace, or inspiration into your daily life, turning your living or working space into a source of emotional grounding.

Supporting Creativity and Artists

By buying art, you contribute directly to the livelihoods of artists, enabling them to continue creating and innovating. This helps sustain a vibrant creative ecosystem that benefits society as a whole. Supporting artists from varied backgrounds helps amplify unique voices and perspectives, enriching the global art narrative and ensuring a diverse array of stories and styles are represented.

Financial Investment Potential

Many art pieces appreciate over time, making them a viable investment option. A well-chosen work of art can yield significant returns, especially if the artist gains greater recognition in the future. Unlike stocks or digital assets, art is a physical investment you can display and enjoy. This dual function of financial potential and aesthetic pleasure makes it a unique addition to an investment portfolio.

Personalization and Identity

Art allows you to express your individuality and tastes. A curated collection of art reflects your personal style and interests, offering a sense of identity and distinction. Art transforms spaces, creating ambiance and energy that align with your personality or professional ethos. It’s a statement piece that speaks volumes about who you are or what you value.

The Case for Investing in Art

Diversify Your Portfolio

Art offers a unique way to diversify your investment portfolio, standing apart from traditional assets like stocks, bonds, and real estate. As a tangible asset, it provides stability and has historically demonstrated resilience in challenging economic conditions. Adding art to your portfolio can reduce risk and enhance long-term financial security.

Potential for High Returns

Art can be a lucrative investment, with many pieces by established or promising artists appreciating significantly in value over time. With careful research and strategic choices, art investments can yield impressive financial returns, especially as demand grows for unique and limited works.

Hedge Against Inflation

In times of economic uncertainty, art serves as a reliable store of value. Unlike paper assets that can be impacted by inflation, art often retains or increases its worth, making it an excellent hedge against currency fluctuations and rising prices.

Build Cultural Capital

Investing in art is about more than financial gain—it’s a statement of culture and sophistication. For individuals, owning art reflects a refined appreciation for creativity, while for businesses, a curated collection can elevate public perception, reinforce core values, and leave a lasting impression on clients and stakeholders.

The Rising Value of Art: A Smart Investment?

Art has proven to be a growing asset, with the Artprice Global Index showing a remarkable 30% increase in value over the past two decades. For newcomers to the art world, starting small is wise. Every art investment carries some risk, so understanding your preferences and choosing pieces you genuinely enjoy is essential.

When it comes to blue-chip art, patience is crucial. These high-value works are long-term investments, often yielding profits over decades. Timing and market knowledge are key—knowing when and where to invest can significantly impact returns.

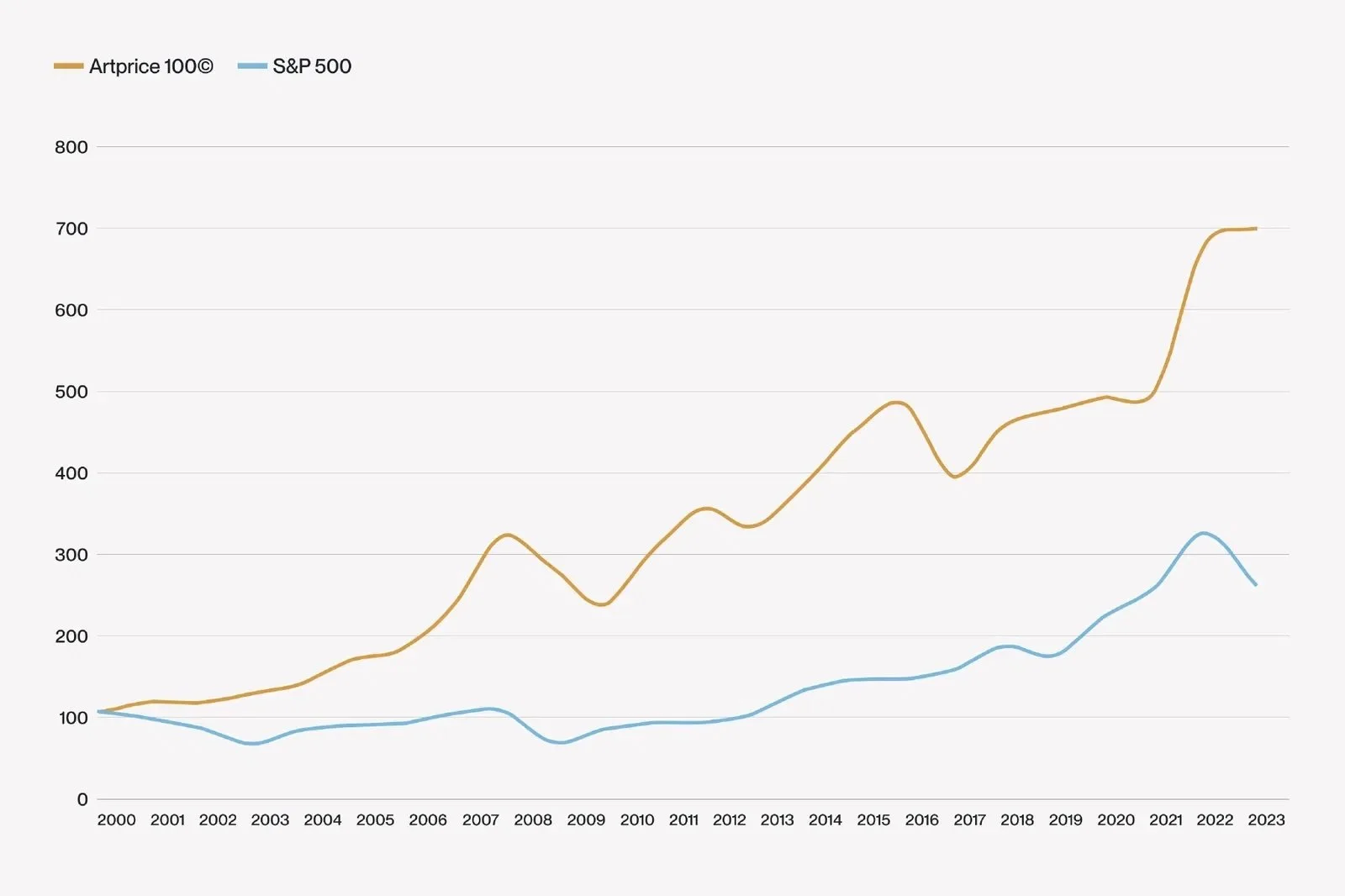

Art vs. S&P 500: A Comparison of Returns

Between 1995 and 2020, the S&P 500 achieved an average annual return of 9.9%. Meanwhile, contemporary art outperformed, delivering an impressive average annual return of 14.3%—nearly 5% higher each year, even amidst major global shifts and events. Historical data highlights the resilience of blue-chip art as an investment. Over the last 18 years, the top 100 artists in the art market recorded an annual appreciation rate of 8.9%, as tracked by the ArtPrice index. In contrast, the S&P 500 provided a significantly lower return of 3.4% during the same period.

Why Choose Art as an Investment?

Art is more than a commodity; it’s a gateway to cultural engagement, personal satisfaction, and financial growth. As the global art market continues to expand, it presents exciting opportunities for both collectors and investors. Whether you’re captivated by its beauty or intrigued by its potential, buying and investing in art is a decision that blends passion with prudence.

Discover the Art Market With Us

Let our team of seasoned art market experts guide you through the process. From identifying promising opportunities to building a curated collection, we provide the insights and expertise to help you make the most of your art investment journey.

Ready to explore the world of art?

Contact us today to start your journey toward owning and investing in exceptional art pieces.