Art Collecting and Wealth: The Role of High-Net-Worth Individuals in the Art Market

High-net-worth individuals (HNWIs)—those with over $1 million in disposable financial assets—form a critical segment in the art market. Although they represent a small portion of the global population, HNWIs hold an expanding share of global wealth and significantly influence market trends through their spending patterns. In recent years, the global distribution and growth of wealth, including the substantial number of millionaires and billionaires worldwide, have created distinct dynamics in art collecting and ownership, influenced by economic shifts and generational changes in wealth transfer.

Wealth Trends Among HNWIs and Their Impact on Art Markets

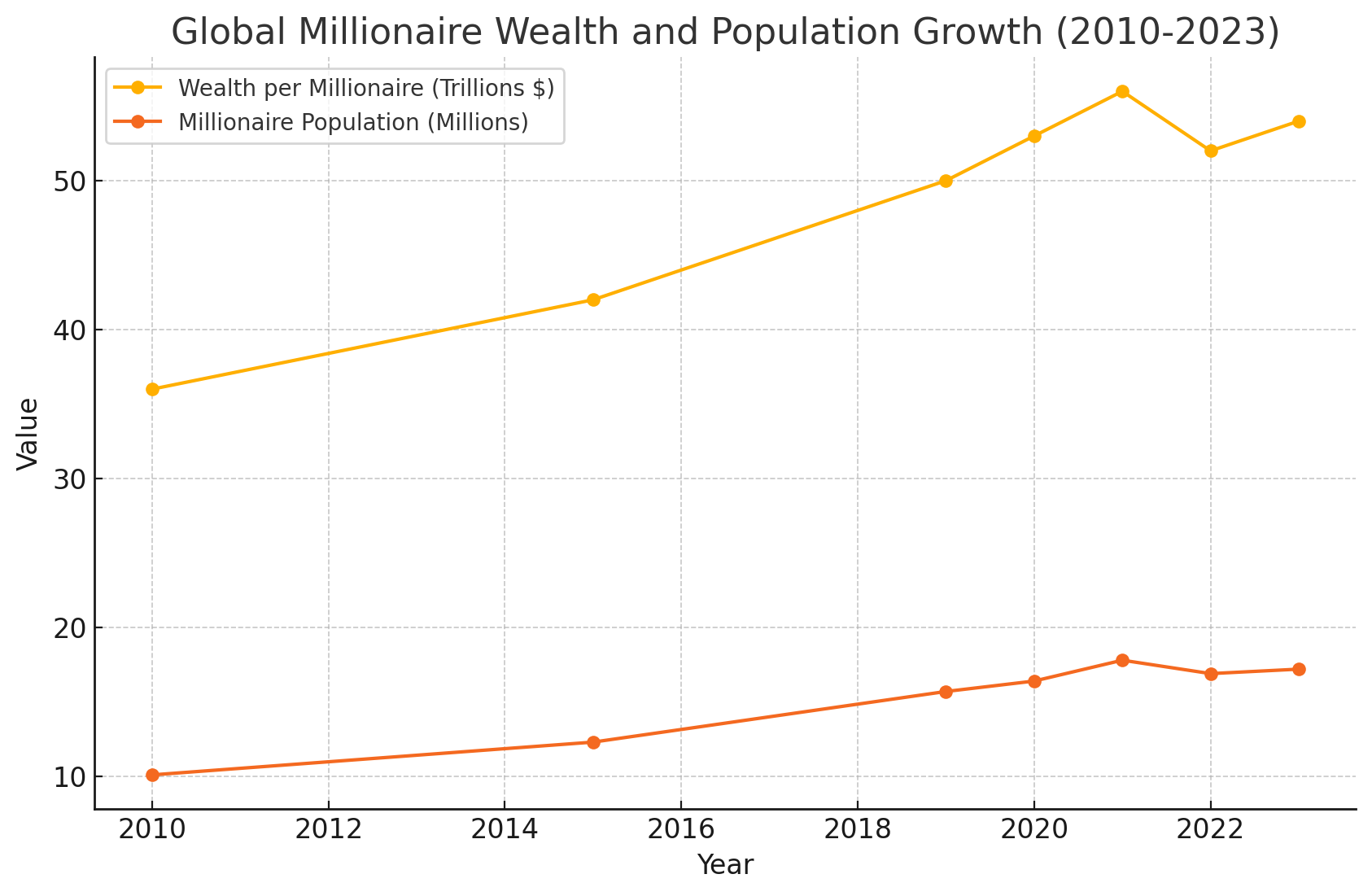

During the COVID-19 pandemic, global wealth levels remained stable, supported by governmental interventions and low interest rates. However, inflation and interest rate hikes in 2022 led to a 3% decline in private wealth, followed by a 4% rebound in 2023. The effects varied regionally, with wealth per adult in the U.S. growing slowly (2%), while Mainland China and Hong Kong saw almost triple that rate. Meanwhile, wealth levels dropped in countries like Switzerland, Italy, and Mexico. Despite these fluctuations, millionaire populations have doubled since 2010, tripling their wealth—a demographic expansion that underpins a large share of art market sales.

HNWIs, particularly those in the top wealth tiers, typically weather economic downturns better than others, sustaining demand for high-value assets, including art. While millionaire wealth dropped by 6% in 2022, it rose by 3% in 2023, even as the overall HNWI population decreased slightly. Over the past decade, HNWIs' assets have grown both in value and number, bolstering luxury sectors and driving demand in the art market. However, this growth has also heightened wealth inequality, which affects the art market by concentrating its value among a narrower group of ultra-wealthy collectors.

Regional Centers of Wealth Among Millionaires and Billionaires

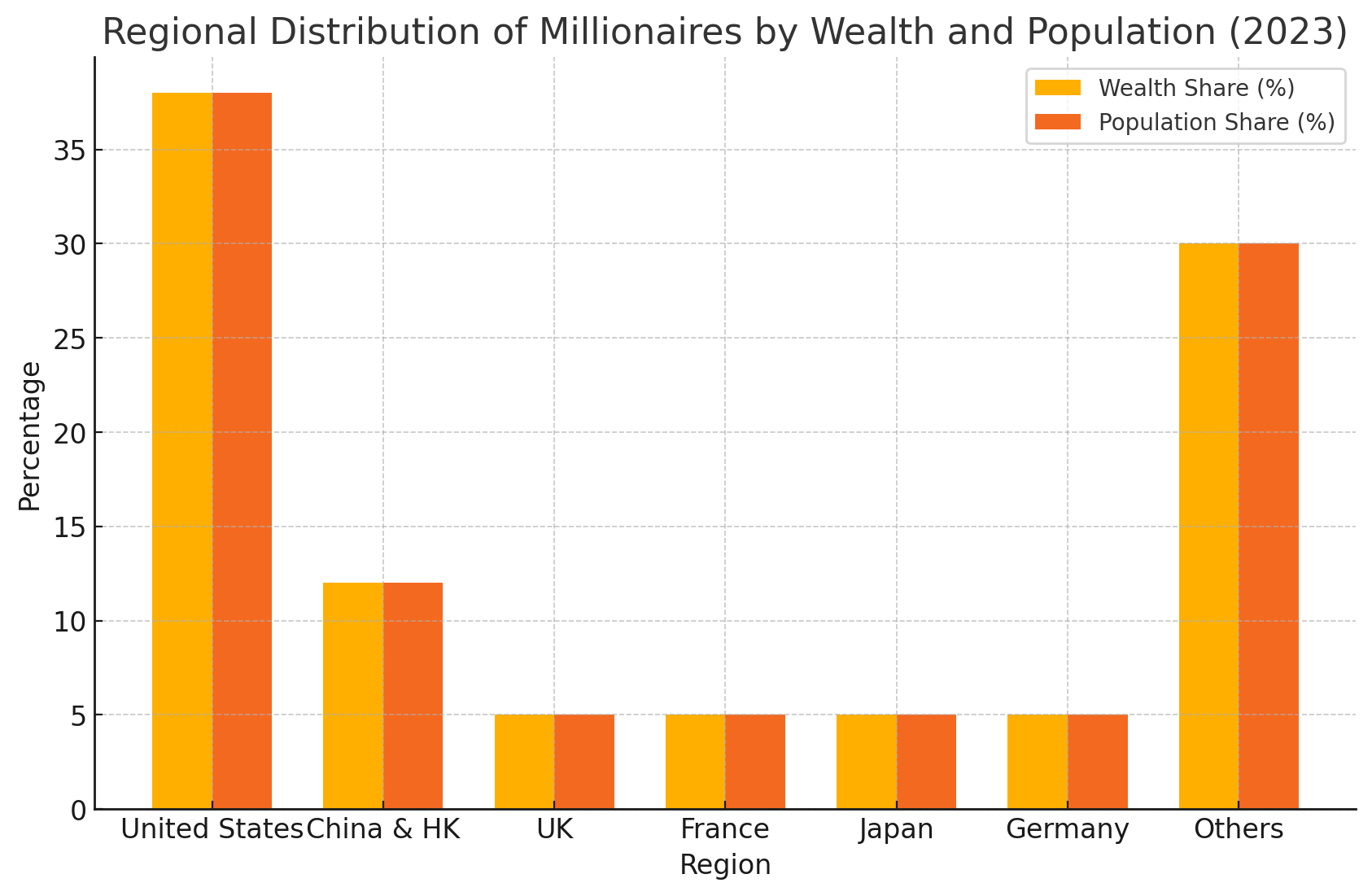

The United States remains the global leader in millionaire and billionaire populations, with U.S.-based millionaires accounting for 38% of the world's HNWI population in 2023, followed by China and Hong Kong (12%). Other significant centers include the U.K., France, Japan, and Germany, collectively holding over two-thirds of global millionaire wealth. The U.S. is forecasted to maintain this lead, with projected HNWI growth in regions across Asia, particularly in Taiwan, Japan, South Korea, and Indonesia.

The wealth held by billionaires has shown robust growth, particularly at the upper end of this segment. For example, the wealth of the top 20 billionaires grew by 34% from 2023 to 2024. In the U.S., billionaire wealth reached $5.7 trillion in 2024, a 27% increase, while China saw a reduction in both billionaire numbers and wealth, primarily in Mainland China. Asian countries like India saw significant gains, driven by a 41% increase in billionaire wealth in 2024. European billionaires also experienced regional growth, with notable increases in wealth across France, Germany, Italy, and the U.K.

The Great Wealth Transfer and Its Implications for the Art Market

An anticipated intergenerational wealth transfer, estimated at $84.4 trillion in the U.S. alone, is expected to reshape the demographics of wealth ownership. With much of this transfer occurring through bequests to Gen Z, millennials, and Gen X, the coming decades may see significant shifts in how younger generations choose to allocate their inherited assets. Many heirs may choose to divest inherited art collections, altering market supply and potentially shifting demand as these new wealth holders bring their preferences into the art market.

Generational differences also play a role in collecting behaviors. Unlike millennials, Gen Z—a digitally native generation—demonstrates a preference for both online research and in-person experiences, potentially shaping future sales approaches in the art market. As these new collectors prioritize access and experiences over ownership, art businesses will need to emphasize both digital and physical engagement to attract younger buyers.

Wealth and Art Market Participation

Not all HNWIs actively engage in art collecting, but a substantial percentage allocate between 20% and 25% of their portfolios to art, with allocations increasing in line with wealth levels. However, allocations among HNWIs have decreased from a high of 24% in 2022 to 15% in 2024. Wealthier collectors, those with over $50 million in assets, still allocate an average of 25% to art, underscoring the importance of these top-tier collectors in driving market trends.

This top concentration of art assets highlights the potential risks of inequality in the art market. Although rising wealth at the upper echelons has sustained high prices and strong sales at the top of the market, an excessively narrow base may hinder broader market growth. To ensure sustained expansion, the art market may need to foster engagement with middle and upper-middle wealth tiers to diversify demand and strengthen the market's foundation.

The Evolving Role of Billionaires in the Art Market

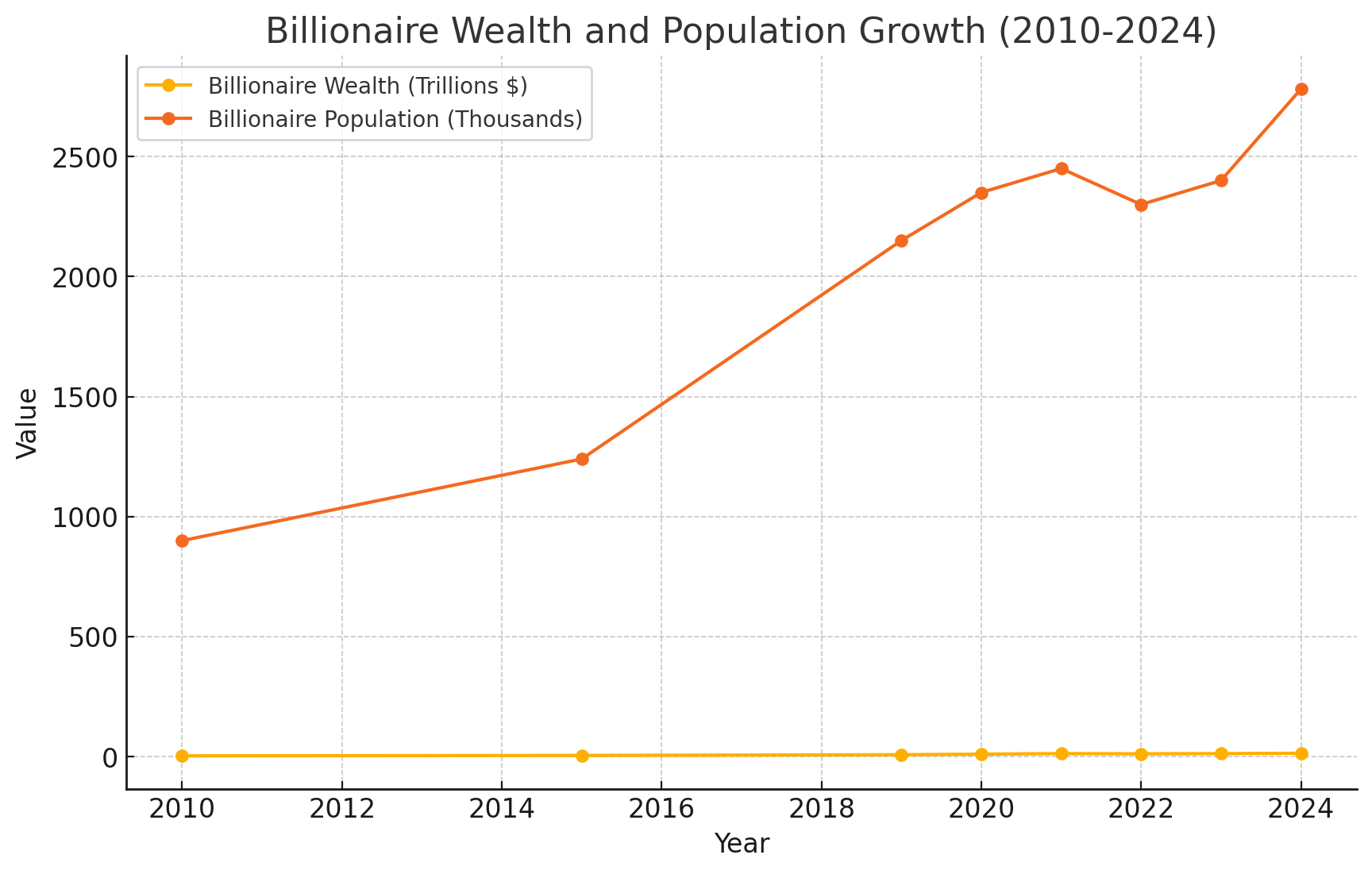

Billionaires continue to influence the art market through both their purchasing power and evolving investment strategies. While the pandemic saw billionaire wealth grow by 64% between 2020 and 2021, a subsequent slowdown occurred until 2023, followed by a robust 16% increase in 2024. The billionaire population, with an average age of 66, is projected to transfer significant wealth to heirs in the coming decades, introducing more inherited wealth into the HNWI segment. This shift is already visible, as the share of wealth generated by heirs among new billionaires rose to 52% in 2023, compared to just 16% in 2021.

This trend of inherited wealth, combined with heightened inequality, may reshape the art market. As wealth consolidates within top percentiles, the market may become increasingly exclusive and concentrated. Although this dynamic has supported high-end art sales and prices, further concentration of wealth could create challenges for long-term market growth, emphasizing the importance of maintaining diverse collector bases to secure a resilient market future.