Reflections on Wealth and Luxury Expenditure

Economic Context and Prospects

As 2024 begins, ongoing wars and geopolitical tensions continue to create significant economic and social pressures worldwide. Economic growth is projected at a modest 3.1% this year, with a slight increase to 3.2% in 2025. These rates are notably lower than the pre-pandemic average of 3.8% from 2000 to 2019. Efforts to combat inflation, high debt levels, reduced government support, and sluggish productivity growth are among the factors dampening economic momentum. However, there are glimmers of optimism: recession fears have largely dissipated, inflation is decreasing more rapidly than expected, and some governments have hinted at potential interest rate cuts. According to the IMF, global headline inflation could drop to 5.8% in 2024 and further to 4.6% by 2025, down from nearly 9% in 2022. These improvements could bolster confidence among art market participants and alleviate some cost pressures that were significant concerns in 2023.

Interest Rates and Market Dynamics

Falling interest rates in some regions could positively impact sales in the coming year. Although evidence is mixed on how collectors incorporate interest rates into their purchasing decisions, a significant and growing proportion of high-net-worth (HNW) collectors use credit to finance their art purchases. Lower interest rates could make borrowing more attractive, facilitating greater spending on art. While many collectors fund art purchases from current income, the use of credit has increased substantially over the past decade. In 2023, research by Arts Economics and UBS revealed that 43% of collectors used credit for art purchases, including 30% who did so in 2022 or 2023. On average, credit financed 29% of the value of their collections, rising to 39% for ultra-high-net-worth (UHNW) collectors with personal wealth over $50 million. Leveraging wealth by borrowing against assets to finance new purchases and reinvest in higher-return assets has been a key strategy for maintaining and expanding wealth.

Resilience and Challenges in the Luxury Market

The art and luxury sectors have historically shown resilience during economic downturns and uncertainty. However, 2023 highlighted that they are not immune to disruptive financial, social, or political changes. For HNW collectors, concerns about wealth creation, stability, and sustainability can influence their willingness to make discretionary purchases. For other wealth tiers, inflation and rising living costs directly impact their discretionary income and ability to participate in the market. Generally, as wealth increases, so does the consumption of luxury goods. Thus, positive economic influences should boost demand, sales, and prices, while negative influences could have the opposite effect.

Wealth Trends and Art Market Implications

During the pandemic, household wealth remained relatively stable due to government support and low interest rates, which buoyed asset prices. However, this changed in 2022 and 2023, as factors like the war in Ukraine led to inflation and rising interest rates, slowing growth and depressing prices. At the beginning of 2023, global personal wealth had fallen for the first time since 2008, although nominal growth of 7% was predicted for the year, or 2% accounting for inflation. Wealth distribution remains heavily skewed toward the top, driving significant trends in art sales from wealthy collectors.

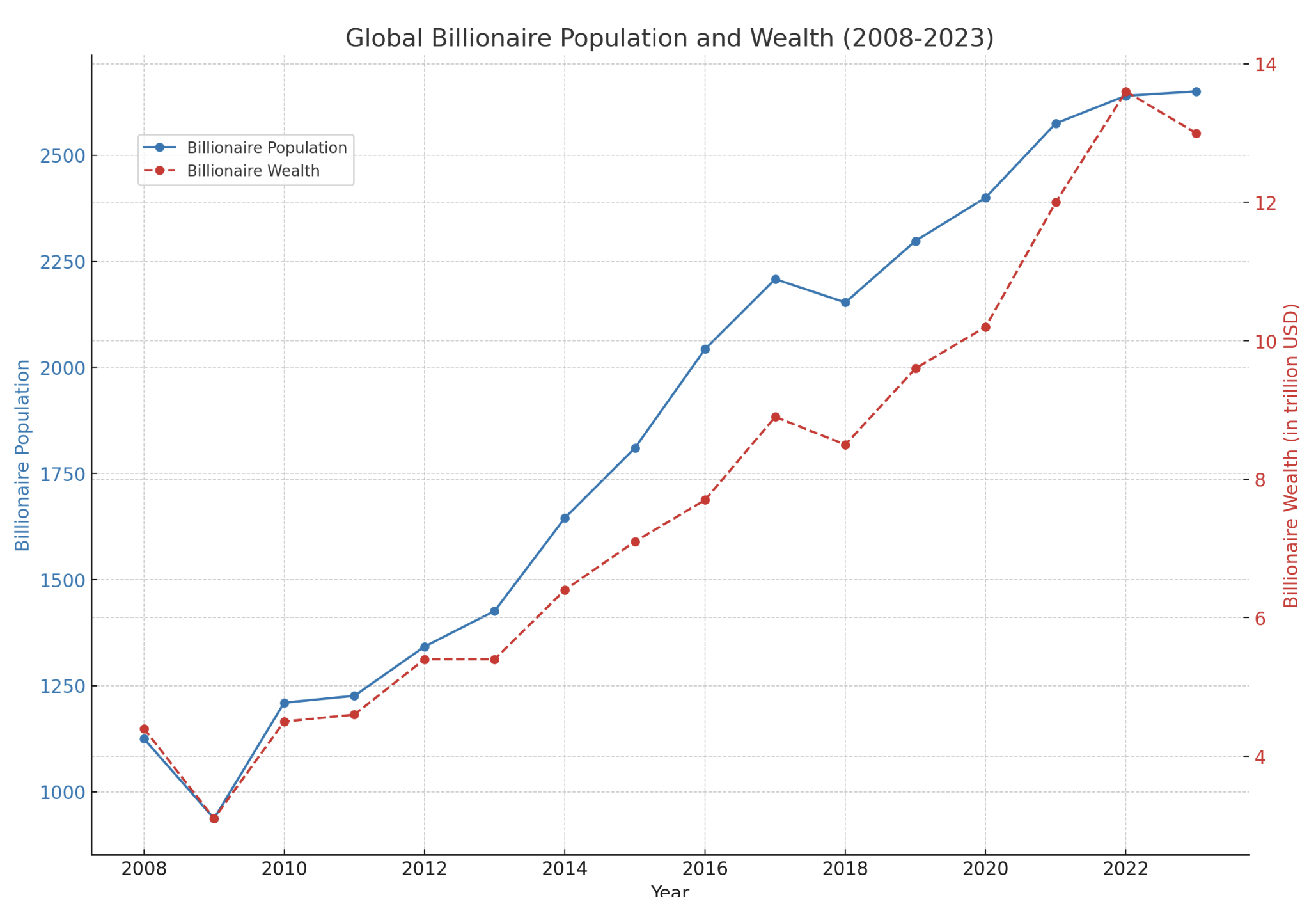

While lower wealth tiers encompass diverse individuals, those in the highest tiers often share similar circumstances, lifestyles, and purchasing preferences. Although not all UHNWIs and billionaires are art collectors, most participate in luxury markets to some extent. HNW wealth was relatively insulated from the economic stresses of the pandemic, aiding market stabilization and recovery. Despite some pressure in 2022 and 2023, this wealth segment has grown significantly over time. Billionaire wealth, in particular, saw substantial growth during the pandemic, peaking at $13.6 trillion in 2021. Although this growth slowed at the end of 2022, it resumed in 2023, increasing by 12% from the end of 2022 to the end of 2023, with 30 new billionaires added.

Collecting Trends and Economic Behavior

For HNWIs who purchase art, significant portions of their wealth are often allocated to their collections. However, 2023 saw a contraction in these allocations, with the average falling to 19%, down from 24% in 2022. This reduction may reflect a more cautious approach to collecting, emphasizing the need for more liquid or income-producing assets. Rising interest rates could also have negatively impacted spending by increasing the cost of credit.

Despite the decline in art allocations, some discretionary spending may have shifted to other luxury markets, which fared better than the art market in 2023. Luxury sales rose by 4% to $392 billion, although growth is expected to slow to 1% in 2024. The luxury goods market, which includes jewelry, watches, and apparel, has shown stronger post-pandemic recovery than the art market.

Market Convergence and Future Trends

There is increasing crossover between art and luxury markets, with many HNW collectors also purchasing items like jewelry, watches, and luxury wine. Luxury sales at major auction houses have grown, introducing new buyers to these markets. This convergence between luxury experiences and products and art could broaden the buyer base and spending in the future. However, there are concerns about the commodification of art into a luxury product rather than a cultural good.

Global Billionaire Population And Wealth (2008-2023)

Chart displaying the global billionaire population and their wealth from 2008 to 2023. The blue line represents the billionaire population, while the red dashed line represents their total wealth in trillions of USD.